A Guide to Reviving Homeownership for Young Canadians

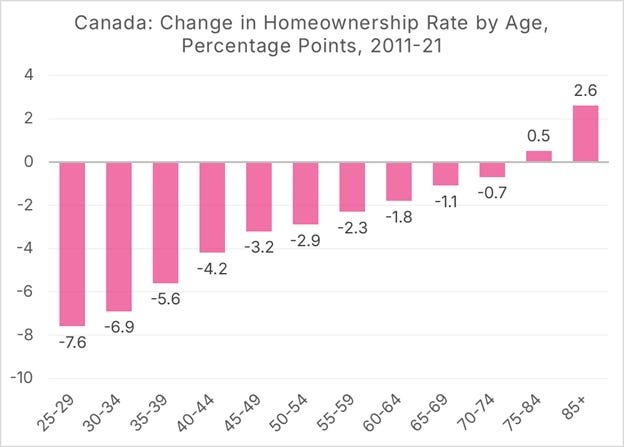

The Missing Middle Initiative recently unveiled a pivotal report titled “A Blueprint to Restore Homeownership for Young Canadians,” backed by the Canadian Real Estate Association. This timely initiative underscores a deepening crisis: a steep decline in homeownership among younger Canadians, particularly those aged 30 to 34, where rates fell from 60% to 52% between 2011 and 2021. Such trends are concerning not only for the affected demographics but also for the broader housing market and construction industry.

Young Canadians retain aspirations for homeownership, with 86% of non-homeowners under 30 expressing a desire to buy in the future. However, confidence is waning, with only 51% believing they will achieve this goal due to rising interest rates, stagnant wages, and escalating price-to-income ratios. This situation highlights a systemic issue: the current supply of ownership opportunities is failing to keep pace with rapid population growth and the increasing demand for family-sized homes. Investors are also compounding the problem by purchasing units intended for owner-occupancy, further distorting market dynamics.

The report outlines four essential goals for the federal government: to scale up housing construction, create ownership opportunities for renters, adapt housing for current families and seniors, and redirect investor activity toward building new rental properties rather than acquiring existing homes. This multifaceted approach calls for ten actionable federal recommendations, including establishing a national housing secretariat, implementing annual housing start targets, and introducing a federal down payment assistance program for first-time buyers.

The implications for the construction industry are substantial. There is a pressing need for increased production of diverse housing options to meet family needs and rectify the housing supply-demand imbalance. Moreover, addressing the obstacles faced by prospective homebuyers, such as the burdensome down payments and high rents, is vital for revitalizing market confidence.

As the report suggests, a comprehensive strategy that integrates different levels of government action is imperative. This coordinated effort aims to foster an environment where housing becomes attainable for all Canadians, not just a select few. Solving this crisis will require innovative policies to ensure homeownership remains a viable dream for future generations. Moving forward, the construction industry must play a proactive role in realizing these objectives, ensuring that policies translate into practical, on-the-ground solutions.

📋 Article Summary

- Declining Homeownership Rates: Homeownership among young Canadians (30-34 years old) dropped from 60% to 52% between 2011 and 2021, with only 51% of those under 30 feeling confident about their ownership aspirations.

- Shortage of Family-Sized Homes: Rapid population growth and investors purchasing family-sized homes have led to a significant shortage of ownership opportunities for younger individuals.

- Comprehensive Federal Strategy Needed: The federal government should adopt goals to increase housing construction, facilitate ownership for renters, and encourage investor activity to focus on building new rentals rather than buying existing homes.

- Actionable Recommendations: The blueprint includes ten specific federal recommendations, such as establishing a national housing secretariat and introducing down-payment assistance to help reverse the decline in homeownership.

🏗️ Impact for Construction Professionals

The recent release of the ‘Blueprint to Restore Homeownership for Young Canadians’ presents both opportunities and challenges for construction professionals. First, a significant demand for increased housing supply means construction companies can secure new contracts to build family-sized ownership homes, especially in light of the outlined federal goals to enhance housing availability.

Actionable Insights:

-

Adjust Business Focus: Realign your project portfolio to prioritize family-sized and "missing middle" housing developments. Engage with local governments to understand zoning changes that may facilitate faster project approval.

-

Capitalize on Funding Programs: Investigate potential funding avenues from federal initiatives, such as the new national housing secretariat and the proposed tax provisions, to optimize financial viability for new projects.

-

Enhance Collaboration: Partner with local governments and stakeholders for public-private partnerships, paving new pathways for streamlined construction processes.

- Plan for Down Payment Support Programs: Be prepared to offer housing options that align with demographic shifts, addressing affordability concerns arising from down payment assistance initiatives.

By strategically adapting your operations to these changing conditions, you can better position your company to thrive in an evolving housing market.

#Blueprint #Restore #Homeownership #Young #Canadians